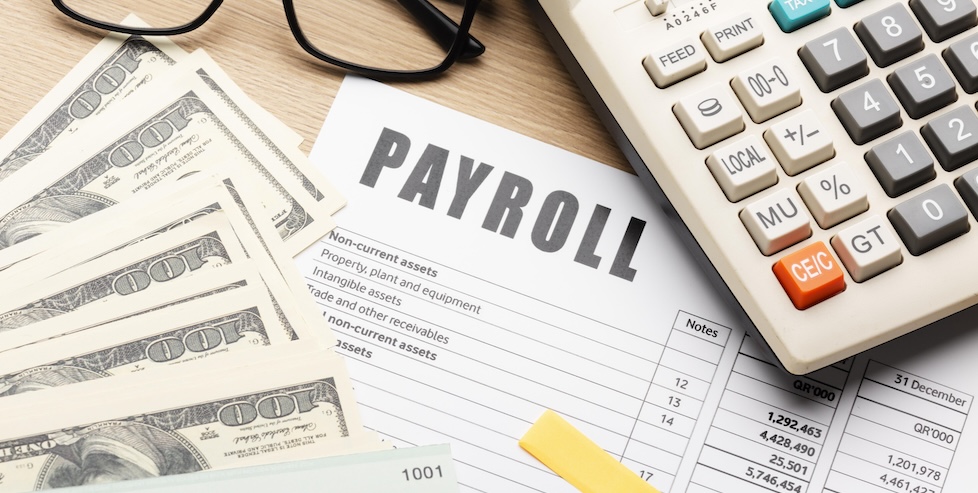

A paycheck calculator is essential for ensuring your employees are being paid accurately. It is a way to calculate salary, taxes, deductions, and net pay. However, payroll calculations are complex processes, and mistakes can be costly. Luckily, there are tools available that allow your employees to run their mock payrolls without impacting your payroll system.

Time-Saving

The paycheck calculator helps businesses simplify payroll calculations and ensure accurate employee tax withholdings. It considers various factors that affect net pay, including federal income tax rates, FICA withholding for Social Security and Medicare, retirement contributions, health insurance premiums, and other deductions specific to the employee’s situation.

By automatically calculating these amounts, the paycheck calculator eliminates the need for manual calculations and saves time. It also gives individuals a clear picture of their earnings after deductions, allowing them to make informed financial decisions and plan expenses accordingly.

When using the paycheck calculator, it’s important to double-check all inputs and ensure that all required information is included. Inaccurate or incomplete inputs can lead to incorrect calculations and discrepancies in the final pay estimate. In addition, it’s crucial to stay up-to-date with any changes in tax laws or withholding rules. Additionally, it’s helpful to experiment with different scenarios to understand how various factors impact net pay. This can be done by adjusting the withholding allowances or determining different contribution levels to see how these changes affect net income.

Employee Self-Service Portal

Providing employees access to their data is an essential tool for any business. Employee self-service portals, or ESS systems, give workers control over their personal information and work life by allowing them to manage specific HR tasks online without going to the HR department. This is especially useful for frontline and remote workers with less time.

A payroll calculator is essential to any HR system because it helps employees understand their net paycheck after taxes and deductions are taken out and how much they will need to save for retirement or other purposes. It also helps ensure that paychecks are calculated accurately.

The free payroll calculator offered by Homebase is an excellent tool for this because it allows employees to track their hours and provides accurate calculations, which can prevent confusion and misunderstandings.

Employees can also use an ESS to request vacation or sick days online, another great way to keep everyone informed and avoid conflicts over time off. This is especially helpful for frontline employees who cannot go into the office to make their requests,

So the ESS allows them to do it independently. Similarly, an ESS can simplify expense management for employees by making it easier for them to submit receipts and get supervisor approval, eliminating the need for paper documentation.

Reduced Risk of Errors

If you’re unfamiliar with payroll taxes and deductions, tracking how they affect each employee’s take-home pay can be challenging. The amount of money taken from an employee’s paycheck is based on state, local, and federal tax rates. Then, there are other deductions like 401(k) contributions and health savings accounts.

These different calculations can add up quickly and easily, especially if you have several employees. A paycheck calculator will help you understand each employee’s salary, taxes, and deductions. This will help you avoid overpaying or underpaying your team and comply with state and federal wage and hour laws.

In addition to calculating gross pay, the online payroll calculator calculates net income (or “take-home pay”). The gross-to-net paycheck calculator considers an employee’s filing status, allowances, and additional withholdings that can be taken from their W-4 forms. It then subtracts these taxes and deductions from their gross pay to determine their net income.

This calculator can be an excellent way for your employees to see the impact of changes in their withholding amounts, retirement contributions, and filing status. However, it is not intended to provide tax or legal advice and should be consulted with a professional advisor.

Transparency

Salary paycheck calculators offer transparency features, allowing employees to see how their after-tax wages are calculated. They can quickly estimate their take-home wages by inputting their pay period, state of residence, federal and local tax rates, deductions (such as 401k contributions or insurance premiums), and voluntary deductions.

Managers can also benefit from the time-saving functionality of salary paycheck calculators by avoiding distractions and other tasks that would otherwise interfere with payroll processing. This is especially true if they manage teams new to a specific process, like driving hourly or salaried wages, paying overtime, or when their workloads increase.

As more companies embrace the concept of transparency, salary ranges are included in job postings to help recruit the best talent. However, this policy is implemented without a solid foundational dataset that maps the roles to their appropriate level of seniority. In that case, it can counteract a company’s efforts to close the wage gap by creating mistrust and confusion among candidates.

To avoid this, employers should ensure that salaries are based on merit, not solely on the company’s unique culture or “rockstar status.” They can also work with their HR team to ensure transparency about compensation policies. This might include describing how bonus payments, annual and spot bonuses, and performance reviews are calculated.

Read more: Decentralizing Finance for Business – Is It Good for Business

Add Comment